“Sell in May and go away, don’t come back till St. Leger”s day”

When trading shares was a manual process, the above investment practice undoubtedly held true 70% of the time. However in this current fast-paced, algorithmic trading world, the results obtained have become no better than 50/50. Effectively the saying is today about as true as any other old wives tale. We do however continue to make higher returns over the Winter months usually. The beginning of 2025 saw early impressive returns eliminated as Donald Trump sent the markets into a tailspin with his tariff announcements. As this behaviour doesn’t occur every year, don’t expect this year to follow traditional patterns.

Politics and Investment

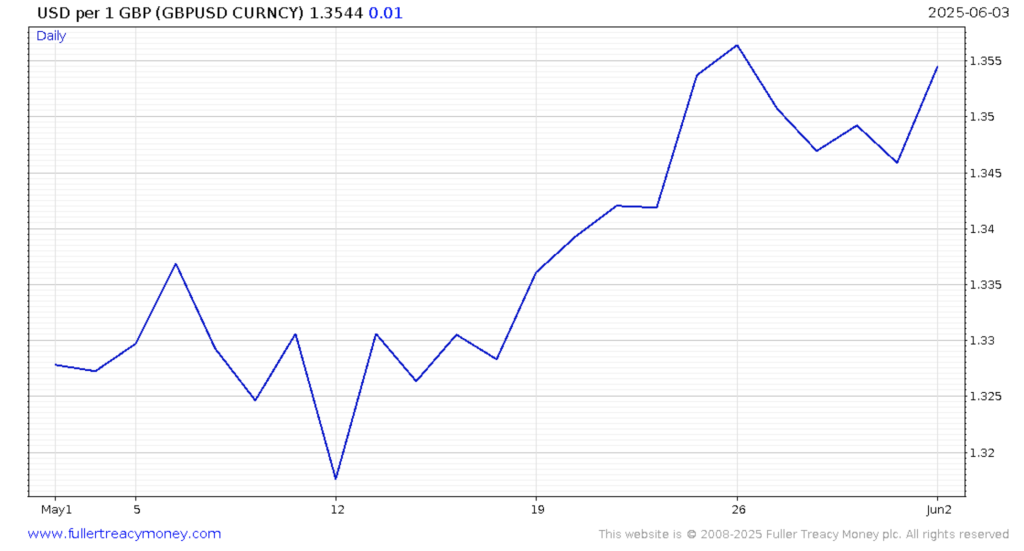

In my previous blog “The stroke of a pen” I quoted Eoin Treacy who correctly deduced that “The benefit of using tariffs for the purpose of manipulating the bond market is they can be turned off with the stroke of a pen.” March was not likely to bring a market meltdown like the structural problems of the Great Financial Crisis of 2009 did. The Trump tariffs have been raised and lowered in successive waves faster than a lady of the night’s underwear. (Toned down analogy to prevent blushes) Through pronouncement after pronouncement on Truth Social, the rattle of a keyboard rather than the stroke of a pen, which have seen the markets, and also currency rise and fall quickly in response. Trying to respond by buying or selling is a fools endeavour. I believe it is important to not let our political affiliations lead our investment decisions. Many Americans sold down and ran to safety, because they were card carrying Democrats. They have missed out on the best May performance of the US markets since the release of “Pretty Woman” in 1990. Our portfolios too have surged, held back only slightly, by a weakening Dollar. I can see the Dollar weakening further, but I cannot see the Pound strengthening much further. UK debt problems look set to accelerate as the amount collected in taxes continues to fall, making investment into the UK fall.

Again US bi-partisan politics is partly to do with the recovery surge. FT journalist, Robert Armstrong has explained the recent surge as the TACO trade. “Trump Always Chickens Out” much to the delight of Democrat voting investors. Trump however is consistently unpredictable, if that isn’t too much of an oxymoron. Continue to expect the un-expected.

May 3rd

Investment history was made on May 3rd as Warren Buffett announced his retirement will finally arrive before the end of this year. Charlie and I were lucky enough to be present. For many years we wanted to attend the annual “Berkshire Hathaway Shareholders Meeting”, so we travelled to Omaha, Nebraska to be there in person. We saw the great and good. Along with Warren Buffett, the meeting was attended by Hilary Clinton and Tim Cook and around 20,000 fellow shareholders. We took the trip as BRK-B is our largest collective holding valued at over £5 million. We knew for many years Greg Abel, handled the business on a daily basis with minimal input from Warren and his recently deceased business partner Charlie Munger. Like most of the investing community we will continue to be holders of Berkshire shares.

To quote a recent Wall Street Journal review by Spencer Jakab, entitled “You’re More Like Warren Buffett Than You Think”, describing the genius of Buffett and how we can emulate his great investment record:-

“The fact that Buffett wasn’t a portfolio manager, strictly speaking, after the late 1960s gave him incredible freedom. He made concentrated bets, including Coca-Cola and Apple. He ignored critics who said he had lost it, such as during the tech bubble.

It hasn’t been a straight ride higher: During his six-decade run atop Berkshire Hathaway, Buffett has trailed the market a third of the time and lost money in 11 years. That surely bothered him, but much less than it would a fund manager facing career risk. Likewise, he never faced pressure to own the Nifty Fifty, Cisco, Nvidia or other fashionable stocks.

It’s well known that 90% of mutual fund managers will lag their benchmark over a decade. Less known is that investors in their funds do even worse, trailing their return by 1.1 percentage points a year, on average, according to Morningstar. On the other hand, a value-stock portfolio—those in the waters where Buffett has fished—has beaten the broad market by an average of 2.7 percentage points a year over the decades.

Not only don’t you have to cave to the pressures faced by the pros. You also can buy and hold the dull stocks, while ignoring the market’s fads and gyrations.”

At the meeting Warren described the shareholders of Berkshire Hathaway to be somewhat unique. 95% of shares do not change hands year to year and for 98% of shareholders – Berkshire is their largest holding. It’s good to see fellow investors have the long term view that we share.

May 4th

Star Wars Day for those with a lisp. As in “May the force be with you” Charlie and I completed the Berkshire Hathaway 5k Invest in Yourself run.

What’s next?

“It’s tough to make predictions, especially about the future” – Yogi Berra

We don’t know what comes next, but we do know that long term investment in great companies has always rewarded the investor. Our investment philosophy remains unchanged and can be simply summarised.

- Minimise costs by avoiding investment into funds which carry an ongoing charge, where we can achieve similar returns without incurring mounting ever-lasting ongoing costs.

- Remember we are looking after individuals life savings. For life. We are long term investors not short-term day traders chasing fads. By holding shares over long periods we minimise transaction costs and hence enhance client’s wealth.

- Benefitting from the economies of scale and control that comes about by using predominantly one platform for dealing and custody of assets. This brings transaction costs down to just pennies per person on rebalances.

- Refusing the FCA permission of “holding client cash”. This gives peace of mind to fellow investors that we cannot run off with your money.

- Our rights as minority shareholders are sacrosanct. We will not invest in rival ideologies in peacetime, which we could find as adversaries in the future. Ignoring this red line would mean embracing the risk of a wholesale loss of assets in wartime. eg. Russia and China.

- Consider all asset classes for investment, eg. equities, bonds, commercial property, commodities and cash, but avoiding the process of investing by textbook theory percentages. If our assessment is that certain asset classes are likely to give negligible or even negative returns in the short to medium term, we will avoid holding them. Certainly government gilts will bring negative returns at some point in the future if increasingly indebted economies bring the fear of reneging on investor interest payments.

- If it is prudent to hold large amounts in cash due to an uncertain outlook for all asset classes, we will not be shaken from our belief. A short term return of just a couple of percent always beats a negative return. Ask Warren Buffett for more clarification who currently holds $300 billion in short term cash.

- We prefer companies with financial moats, another idea co-opted from Warren Buffett decades ago. Companies that are protected from competition from new upstarts due to their licences, intellectual property, market domination, infrastructure or technology. eg. Apple, Walmart & Costco.

- We are not investors in those investments restricted by Ecological, Social or Governance scores. We will remain agnostic on climate change as investors. We will therefore not be forced to favour green companies over other any other type of company. If clients prefer to invest in this way, we understand we will not remain their first choice as investment managers.

2025 is turning out to be a topsy-turvy investment return year. We will react when necessary and hold fire on rash movements in reaction to sensationalist media. Business as usual really. Perhaps the years of studying the finest investment partnership of all time has rubbed off on us.

Excellent Blog Howard. See you soon.

May the farce not be with us for too long.

Thanks Howard, interesting as always. Looks like you had a good time in the US, not somewhere that terribly interests me to visit at present.

Trump must make your decision-making interesting… shall we say. I’m sure you’ve probably listed your investment philosophy before, but it’s reassuring to see that it accords well with me.

Hi Peter

Thank you for your comments. Many individuals and 95% of advisers simply hear how we should invest and follow the crowd. Without question most of the textbooks and theory that has been quoted, comes from investment industry funded “research”. Unsurprisingly it always leads to giving the largest investment groups, with the deepest pockets to fund the white papers, all of your assets to invest. And of course once they have your money, the idea of moving it away, even temporarily in times of extreme stress, is not something they recommend. Experience has taught me that avoiding the lame ducks is all that is necessary to receive market returns. Underperformance is always cited for avoiding making our own investment decisions, instead of not just investing in their index trackers. However much of the research includes funds that charge 2% per year and in those years of exceptional over-performance a further 20% of the excess profit. It is high charges alone that doom many clients to less than average returns from active managers.

Thank you Howard, an interesting and informative blog,

Best regards

Val

I see Germany has the second largest gold holdings after USA though China is catching up. In view of geo/ political risks especially the looming 2027 target date for China/Taiwan confrontation, would you consider physical gold 2030 futures as over optimistic at $5,000?

Hi Dick

Since many of Russia’s assets were sequestrated at the commencement of their invasion of Kiev, many international governments have been returning assets to their own shores for safety. Germany has repatriated much of its own gold back home from the US. However it was the weaponising of the SWIFT banking system by the US against Russia that has made many governments question their security policy. Without the free international movement of currency, countries could be defeated using banks not tanks. Gold has once again become a unit of currency. It was President Nixon who removed the peg of the Dollar against the price of gold. Since then there has been a steady devaluation of currency due to rising inflation following the issuing of more and more paper money. I won’t spoil my next blog, but you will hopefully get something of value from it. The theme is “What is Money?”.

In answer to your question, I have linked a long term chart of Gold, put on a logarithmic scale to better show the explosive movements and long term consolidations that follow.

We are still within an explosive growth period which has further to run I believe. Looking at further research on the movement of gold, it seems that there is a co-ordinated move by many European governments to build up to 4% of monetary assets as domestically held gold bullion. Perhaps we are looking at a future currency pegged to gold once again?

I know you are wary with your own gold purchases. Stay physical. Our platform assets are certified physical, not just a paper bet on the future price of gold. There is 10X the amount of currency bet on gold than physically exists! Physical gold amounts to about 5.5% of our portfolios with a further 4.5% in a gold miner, Newmont Corporation. I think that tells you I’m still very bullish gold.

Good to know we continue to be in the safe hands of Howard, Charlie & the team.

Thankyou