It seems like we have had to wait an age, but there is finally some positive movement in the markets. It’s about time too.

We have all received our quarterly statements from Nucleus and it has not made for comfortable reading. The markets fell dramatically in the last quarter and the statement reflects the value at the beginning of January. That was just about the nadir of the recent slump.

Clients who log on to their Nucleus accounts regularly, were aware in real time of the drop in values. Clients who read the blogs were also aware, but for those clients who never check the platform or read the blogs, the letter through the door from Nucleus a week or so ago was possibly their first notification that values had fallen.

The last quarter also saw the first trigger of the MiFID II 10% valuation drop alerts, which we emailed to holders of our AIM Portfolio and our Aggressive Portfolio.

How can I check my current value?

Here’s the link to the new Nucleus beta site which gives you your valuation in graphical form and tells the whole story. It’s brand new, and still in testing phase, but I’m sure you will like it.

Here’s how valuations have recovered since the start of the year 6 weeks ago.

+4.32% Cautious

+5.30% Moderate

+6.09% Aggressive

+8.32% AIM

So what now?

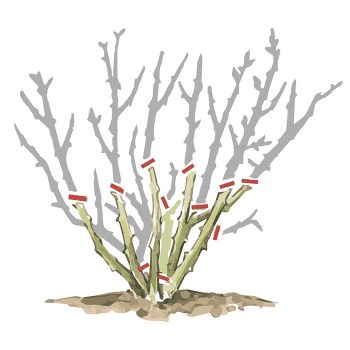

Business as usual as always. As investors we understand that occasionally valuations need to go south, but usually go north. We take market events like this as an opportunity to re-shuffle the deck. We have been undertaking some pruning & re-sowing. We last pruned in May & June (almost the zenith of the year) last year and are very late re-sowing. We normally make most of our years growth between October and May, unlike a farmer. However this season has been different.

Sell in May & go away. Come back St. Leger’s Day.

Happily for us all I duly sold and created varying amounts of cash dependent on your attitude to risk. Cautious Portfolio in cash was 42%. Moderate was 33.5%. Aggressive was 24.5%.

St Leger’s day came and went on 15th September. I didn’t buy. That was 5 months ago. Like everyone who remained invested, we suffered some of the global market falls (isn’t not just Brexit), but our healthy levels of cash were left high and dry and reassuringly intact.

I’ve been looking to buy some cheap investments since with this cash, but not expecting to buy right at the bottom, as nobody can do that unless they are very lucky. But now a full 5 months after St Leger’s Day, it’s time to make the move. I can see green shoots.

Cut it hard back, remove the deadwood

When I select a share for our portfolios, I always intend to keep it forever, however it doesn’t always work out that way. I have just set about a deadheading. I’m sure everyone will be happy to see the back of Dignity and CVS. I know, neither selection was my finest hour. Although in my defence conditions do change. A price war with the Co-op and then a government enquiry into the price of funerals has decimated Dignity’s share price. With CVS the vet consolidator, it was a case of too far, to fast and too much debt that spooked investors. I’m yet to see a pet owner who doesn’t think vets are profitable though! I will keep an eye on both in the future, all (most) dogs have their day.

Still I avoided Patisserie Valerie and Conviviality both of which have all but lost all of their investment value. I had considered both as potential investments on several occasions since 2014 but thankfully decided against them. I never thought Carillion was for us and it turned out to be wrong for all investors.

I’m not going to mention all of the successes and the long term holds.

The crop of 2019

It’s time to start re-sowing the new crop. Many of the companies I have chosen to invest in today, I have followed for some time. In a few cases years. Waiting for a suitable entry point. I’d like to welcome A.G.Barr the maker of Irn-Bru (I don’t like it) and Just Eat, beloved by millennials who can’t tear themselves away from the sofa. The buying starts very shortly, so expect to see our airbag full of cash invested over the following weeks.

I have threatened to reinvest continually over the last 5 months. The time is finally upon us. At last!

As always if you have any concerns or would like a review to ensure you are happy with the Portfolio that you are invested in, just call and we can put some time in my diary for a meeting. If this period of extreme uncertainty (the first really since 2011) has given you sleepless nights, it’s time to shift down a gear to a lower risk portfolio. If you have taken all this in your stride as an investor, let’s talk about shifting up the risk scale, perhaps with just some of your investment capital.

Onwards and upwards!

Great to hear some positive news , we all knew it but there’s too many doom merchants on the news talking us all down . Nice one H

Howard, unless you are planning to “stitch us all up” (which I’m sure you’re not!), then I think you mean “sowing” rather than “sewing”!! Thanks for your informative insight as always, Ruth

Hi Ruth

I like what you did there. I’ve patched it up now. I could blame it on the spell-checker but it was down to me.

Regards and hope the skiing was good

Howard