This week has seen a major rebalance of all of our portfolios. There have been many changes made with long loved shares sold and new, previously avoided shares bought. So what has brought about this change?

Every Dog Has Its Day

The FTSE 100 index has faired better than most stock markets around the world and for good reason. It is jam packed with shares which have faired badly over the last two decades.

“A funny thing can happen when you don’t have any exposure to Technology stocks….

And that’s precisely what’s taking place in the United Kingdom.”

JC Parets

…he goes on to state

“But the consequences of its weightings are that the underlying index FTSE100 has done absolutely nothing for 2 decades.

If you would like to read more about the FTSE 100, follow the link below.

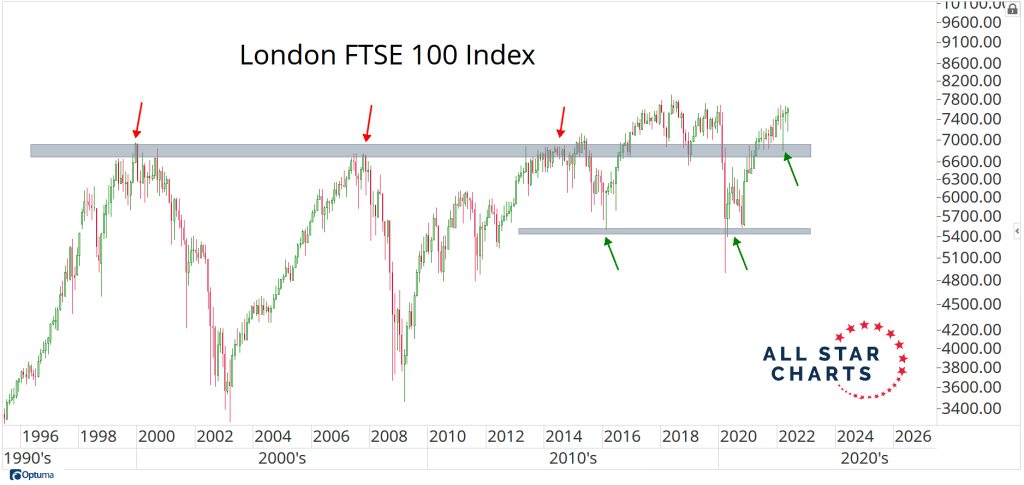

Here’s how a leading US technical analyst presented the current turn-around.

There is more to the FTSE 100s relative over-performance other than the fact it holds no tech stocks.

- Around 85% of the income generated by the FTSE 100 constituents is denominated in dollars, because many companies are involved with the extraction, refinement and shipping of basic raw materials, oil and gas.

- The strength of the Dollar versus all world currencies – or if you read the Guardian – the weakness of the pound.

Conscientious Objectors

We have an open mandate to manage our portfolios. We do not have too many clients who ask whether we invest solely in the better companies contained in the Environmental, Social & Governance Indices. Return for most is paramount, if we can grow our savings we put ourselves in a position of strength where we can individually surrender some of our profits to ESG causes that we care about. However with the recent company additions into the portfolios of oil exploration, mining, tobacco, aerospace and weapons companies, this is indeed quite a change. Now would be the time to tell us if you would prefer we selected from a narrower base if you have objections to these “not so ESG” choices.

So Why The Change?

It is clear the world has become a darker, less friendly place since Putin’s invasion of Ukraine. Without the plausible threat of war, governments have been free to reduce defence expenditure to a minimum, causing defence sector shares to struggle for years. Carbon economy shares seemed destined to be eventually wiped out unless they switched to more sustainable forms of energy. Indeed, instead of the previous scenario of “peak oil”, where demand grew at such a rate that carbon based fuels could not be extracted and refined any faster, hence driving the prices up. We entered a new scenario where global demand fell to such a low level, driven by governmental zero carbon mandate, that prices fell and reserves would be left in the ground. Energy independence is now once again viewed with the utmost importance and that simply isn’t achievable with current sustainable forms of energy.

Investors see future value in these previously pilloried shares once again. It will drive values higher.

And those shares sold?

We have left a growth environment as interest rates continue to rise. Some of the fabulous growth stories we have previously invested in, now are much less attractive in the short to medium term. Hopefully we will see interest rates normalised within a couple of years, but for now we need to accept that the environment that drove returns in the past just doesn’t exist today. We culled many in February at the last large rebalance, a decision that looks very good in hindsight.

False Dawn

From a brief pick-up, markets have taken a turn for the worse with a 0.75% rise in interest rates which wrong footed the markets once again. There have been further signs of capitulation (less confident investors throwing in the towel completely) and further evidence of other investors buying the dips. As I have said in previous blogs the markets will commence their recoveries well before interest rates are normalised, but it’s a fool who thinks he knows where the lowest point will be. Have we passed it yet? Nobody knows.

All we can do is hold tight as investors. That doesn’t mean we shouldn’t shuffle the pack as good cards turn bad and previously bad cards turn good. As ever the only constant in investing, and in life in general, is change.

Thanks for explanation, we did think there had been a big fall again. While we would like to be environmentally conscious we agree with your sentiments. We will continue to try and reduce our carbon footprint at home. Bernard is currently replacing the loft insulation and wishing he had done it in cooler weather.

kind regards,

Karen & Bernard

Morning Howard,

As you say, we have entered a time of great change.

Will be interesting to see where we go & how we perform over the coming months.

Hope all is well with yourself & the team

Regards Michael

Given my previous career I’d be disappointed if you didn’t invest in weapons.

Bet nobody knew I looked after anyone with such a high security clearance. Our secret 🤫