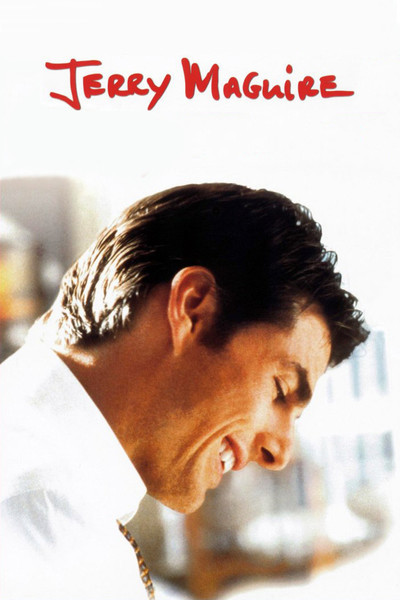

I was reminded of the 1996 film Jerry Maguire recently when I was advising a client. It starred Tom Cruise and Cuba Gooding Jr as football agent and client. If you haven’t seen it you won’t recognise Cuba’s catchphrase above. As an investor it’s a question I always pose when assessing any opportunity. “Yes, perhaps I can see what you are saying, but show me the money!” Often it is nowhere to be seen and in many ways it is never what it seems.

Who Want’s to be a Millionaire?

Like many of our clients, Lesley & I could say we are millionaires. Having £1,000,000 or more, was never a dream as 10 year olds as it seemed impossibly out of reach, but approaching age 60, working since we were in our late teens and long-term inflation have all contributed to our life savings.

However £1,000,000 today is the equivalent of just £70,000 in 1971, because according to the Bank of England inflation has been running at an average rate of 5.7% over the intervening period. Their maths seems wrong somehow, but some of us do remember an average annual inflation rate of 7.5% and mortgage rates of 15% per year.

If you are interested Lesley & I would need a combined £14,455,000 today to consider ourselves the equivalent of being classed a millionaire in 1971. Astonishing and really quite humbling. If you want to try the calculation yourself, here is the link.

Fur Coat and ……

Currently I have £20 in my wallet. Not much for a millionaire. It’s my emergency twenty, just in case every electronic method of payment I have fails – or I need to buy something small where the vendor insists on defrauding HMRC. I’ve had it for ages, because since Covid appeared there are not many places that don’t prefer to be paid electronically. This must make Hector The Taxman chuckle somewhat.

£20 may not be a lot, but it is real. I can touch it. I can count it. Twenty. Maybe I should swop it for 20 £1 coins as counting would be more interesting. 1,2,3….. Most of all – I can show you the money!

What about the rest? How might we consider ourselves to be millionaires? Let’s look under the bonnet of our life savings.

Bank Accounts

The amount we have in our bank accounts are calculated in real time. We can see our total in our banking apps. Surely we can rely on this figure if we had £1 million in the bank. Well no actually, there are a couple of problems with that assumption. We all know about the FSCS guarantee which is well below £1m. So we would need 12 accounts with 12 different banks which are not in the same banking group to ensure the £1m is safe if a bank collapses. However I’m pretty sure that if one bank collapses the chances are the ensuing chain reaction would take them all out. You see, we would all want our stack of £20 notes back pronto, from not just the collapsing bank, but from every bank. The queues would be longer than those on the M25 when Insulate Now protesters are about. We saw these queues when Northern Rock first looked a bit dodgy in 2007. People panic.

I’m sure you know this – but there just aren’t enough £20 notes in existence to pay us all out at once. Physical cash is a tiny component of global savings. We have to just trust the banks. – Show me the money! Banks can’t.

National Savings & Investments

They don’t exist! Honestly. It is a giant Government Ponzi scheme, they spent your savings years ago. Please don’t all ask for your money at once. Governments have none, that’s why they borrow all of the time. As for that £1000 in premium bonds you bought in 1971. It still has a face value of £1000, but it can only buy goods to the equivalent of just £70 today. I hope you have had some big regular wins along the way. – Show me the money! They certainly can’t.

Property

What’s something worth? It’s worth what someone will pay for it. Most homes and other physical properties are not on the market most of the time. Many of us bought houses 20 years ago. We knew what we were prepared to pay for them back then, but we are not buying them again – someone else is. If we get three estate agents in to take a look, there would undoubtedly be three very different valuations, none of which would be the final price settled on in a sale. A property is therefore only valued a few times in total, between those times its value is anybody’s guess. Often we cannot be accurate to within £25,000, £50,000 even £100,000. – Show me the money! You can’t until you’ve finally sold it.

Shares

I will include funds in this section because most funds are simply a collection of shares. Here actual valuations are very different to property valuations. If I own a share there is a fair chance an identical one changed hands today. Therefore we can be much more accurate when we say our share is worth £20. However the guy who bought a minute ago got what he needed, so I’m looking for a new purchaser now. Share vales are “marked to market” the value given reflects the latest prices bought and sold at, but tomorrow anything can happen and usually does. I can only ever say I owned £20 in shares yesterday, because tomorrow it could be £19 or £21. At least it can be said that more accurate valuations can be ascertained with company share ownership than with most other holders of value, albeit historically.

Now here’s a thing, Companies are rarely bought and sold in their entirety, but we assume that if we wanted to buy an entire company all we would have to do is multiply the current share price by the number of shares the company is split into and then cough up the cash. Entire companies are never valued like this however and besides, the largest companies in the US have a market capitalisation in excess of £1 trillion. Who can afford to buy one of those and test the theory. – Show me the money! – You could yesterday but it was still just an educated guess.

So what?

A couple of weeks ago we had a calculated value of £110,000,000 between us in our portfolios. Now we have a revised calculation of £105,000,000 between us. Obviously this total has fallen. What is quite strange is that just a few months ago we were delighted to have £105,000,000 between us, now, not so much. In a fortnight it will be different value again.

We can’t help feeling like we have lost something. But we haven’t – we still own the same companies – it’s just that we can see the estimated daily value has changed and we anchored on a previously higher estimated one, never a previously lower estimated value. We always believe our portfolio value to be gospel in a way we believe our bank balance actually exists as £20 notes and our house is worth what an estate agent says it is worth. They are all just guides really.

The only reality

There are really only two monetary measures that matter. We either are fortunate enough to have enough, or we are unfortunate. Chances are £5,000,000 lower between us still counts us as members of the first camp. We now collectively have less time to spend or build our life savings than we did a couple of weeks ago. In a couple of weeks time we will have less time again.

Let’s get busy living.

YOLO

The Government is spending our money. OK times have been totally abnormal.

I wonder when the Gov will off set the politically difficult decision to raise NIC’s by introducing a single rate tax allowable pension contribution by equalizing standard and higher rate allowance at around 30%; ( Red Wall seat friendly). The second hit will almost inevitably be aligning CGT rate with the tax payers’ income tax rates. Thought I would think that Business owners’ rate will have to be different. I don’t see the minimal Corporate tax rate of 15% bringing much relief to UK as the Irish will fight tooth and nail for as many exemptions as possible.

Difficult times ahead tax wise.

Another interesting blog.

Thank you Howard.

Thanks Dick as always for your comments. Tax relief given at 30% for a retired person with income higher than £50k, just isn’t tax relief. 30% relief in but 40% charge out equates to a 10% tax charge in retirement. I know 25% can be taken tax free (currently), but that usually is spent very early on in a 30 year retirement. It’s a difficult choice they must take. Only longer term higher inflation will erode the huge debt burden, but not too high as it will raise interest rates and governments globally will be pushed into default. We collectively don’t own any government gilts. 👍

Great article puts life and savings into perspective

Thank you.

Loved this blog Howard!

I look at my account twice a year, sometimes it’s great sometimes it’s hmm. But I can remember having nothing so I’m quite happy. And easily pleased.

Central Bank Digital Currency since that’s a hot topic, no one will show any one any money then.

Another very insightful and “simple” blog. Always good reading!