I wrote this blog on 22nd March, having reduced equity holdings by up to 50% in our portfolios a day or two before. Unfortunately I was then out of the office for a week and forgot to publish it. For all our discretionary clients the proof of the pudding will be in their quarterly valuations. – Howard

With the markets at such a high level at the moment, many of my clients have been asking what my next course of action will be. Allow me to firstly explain what ongoing investment service most clients experience currently. Many in the investment profession advocate looking at your investment much like a marriage. You form a life-long bond with your funds.

I take you, my recommended funds, to be my partner, to have and to hold from this day forward, for better, for worse, for richer, for poorer, in sickness and in health, to love and to cherish, till death us do part, according to God’s holy law, and this is my solemn vow.

Now if I earned my living by creating funds and then finding investors, I too would not encourage investors to take profits regularly. Perhaps this idea of buy and hold originated from investment groups with vested interests and shareholders. Much economic theory states that markets are random and you can’t time them. In the short term the idea of buying low and selling high is impossible. However it is currently felt we are due a setback. Ask anybody and they will tell you that since we have had almost the best January & February on record, we shouldn’t expect that to continue.

How much is enough?

Sometimes it’s worth remembering how much has been made, and just how quickly that growth has occurred. If the rise is significant the risk of losing it becomes greater than the risk of just not making anymore.

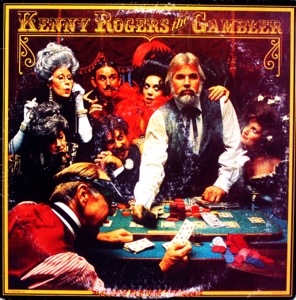

You got to know when to hold ’em, know when to fold ’em,

Know when to walk away and know when to run.

You never count your money when you’re sittin’ at the table.

There’ll be time enough for countin’ when the dealin’s done.Kenny Rogers – The Gambler

Incidentally I wrote this entire blog on my iPhone. Not easy but accelerating technology makes more possible all the time.