Tour de Force

I couldn’t start a blog about cycles without mentioning Chris Froome. Crowned supreme champion of the national sport of France this weekend for a fourth consecutive time. It’s a great U.K. Team achievement. Over the same weekend our ladies cricket team became world champions and in golf, Royal Birkdale was the spectacular stage for one of the four major global trophies. Well done us! It just a shame the Claret Jug was taken home by a Texan. Anyway down to business.

Market Cycles

A typical boom to bust cycle for the markets lasts on average seven years. This current cycle picked up from its bottom in April 2009, shortly after the financial crisis and the global crash that followed. So look at the maths, 2017 – 2009 = 8 years. Are we due a crash now so the next cycle can run once again? If you had listened to many “experts” we were overdue a correction in 2014!

Spot the Difference Competition

The difference is a cool 33% higher! The S&P 500 has gained 600 points from 1800 to 2400.

Let’s travel back, It’s January 2014

I had written my usual quarterly investment update back then and indicated that a head of steam could be building. Could it be we were about to embark on a 20 year investment run? Below I have copied what I said back then. Here’s the link to back then too.

We humans extrapolate. We look at what has happened in the recent past and then use this as our model for the future. This has got us through 2 million years so far.

- Tigers kill us – best avoid

- Toadstools usually kill us – best avoid

- “Everyone is doing well invested in shares – Let’s buy now”. I don’t think so.

- “Everyone has lost loads of money in shares – I’d better sell mine”. Again, I don’t think so.

So short term extrapolation is the worst thing you can do in investment. Let’s not buy high, sell low and repeat until we are broke. If I was remunerated for selling individuals investments I would be shouting “get in now, just look at how we have done”, but I’m not, I’m paid to help investors look after their life savings in harsh times and prudently help them to grow their life savings in good times.

Does history teach us nothing then?

We should ignore what has happened in the short term, in fact we should often do the opposite! But long term investment truths do show through.

We are here! Shouldn’t I be worried?

The (2014) chart (first chart above) shows the S&P 500 and the FTSE 100 over the last 20 years. The S&P 500 has never been higher, the FTSE 100 is not far off the high it reached in 1999. Twenty years of history, (I’ve only been involved with investment for 27 years) would suggest we are about to enter the highway to hell for several years. The markets must surely fall. All those latecomers who are only just investing today are going to get burnt surely? It probably won’t be the first time they were late to the party having only just got over their losses in 2008!

You may have noticed that your plans are very cash heavy at the moment, and I think now you can see why.

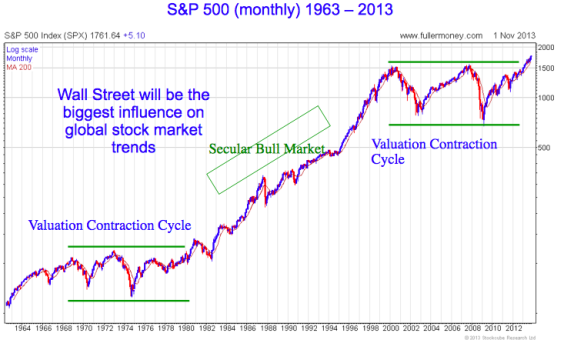

Now this would be the end of the blog if I hadn’t been to lot’s of meetings in November and December (2013). I decided I needed more experience than just 27 years to try to figure this out so I went along to listen to individuals that have been successfully investing since the late 60’s. (I was only born in 1961). So look at the chart below.

This chart ends at the same point, but begins in 1963. Now that doesn’t look too bad now does it? Perhaps this isn’t a re-run of the last 20 years. Maybe it’s a re-run of what happened after the recession of the 1970’s? Maybe we are about to embark on an extended period of huge global growth. This time brought about by ever accelerating technology, a huge migration to the middle class in India and China, and cheaper global energy costs. (But not in Europe, mainly in the USA where energy costs are 4 times cheaper than Germany where they won’t frack) Any one of these 3 factors alone could fuel a boom.

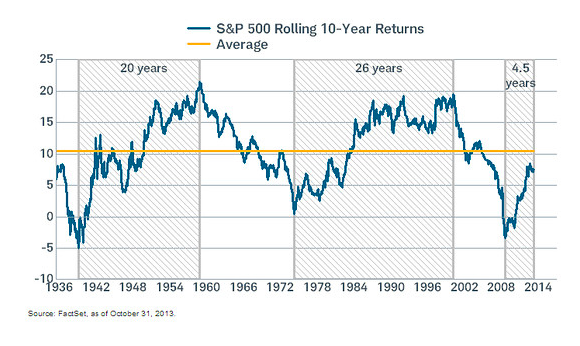

The same graph below is another I came across at an investment meeting, where the same conclusion has been arrived at, but it suggests the boom has started already and probably has a further 20 years or so to go.

By the way, I never attend meetings where products are being sold or there are vested interests at play. I pay to attend these meetings.

Now we are confused. What are you going to do?

I’m going to carry on each day with an open mind and look for trends to develop. I am certainly not going to try to best guess whether we are on the edge of the abyss or about to embark on the investment journey of a lifetime. When I’m not sure I ensure profits are made safe so losses will not be huge, especially when we have done so well over the last couple of years.

Back to the Future

So I’m back with you today. There is now a growing belief that this is not merely a normal market cycle, but rather a secular bull cycle. They do not come along very often, maybe just once or twice in an investors lifetime.

Rest assured however, I will remain vigilant. The last thing I’m going to do is just believe it will be Hunky Dory for another dozen years or so. But wouldn’t it be nice.😀