Inflation

When George Harrison wrote “Here Comes the Sun” it was 1969. Inflation was being monitored on a long term index which had commenced in 1947, shortly after WWII had ended. Commencing at 30 points, 18 years later in 1969, the index had risen to (coincidently) 69 points. 30 is an odd level to start an index you would think, but the data had been re-assembled in 1974, with a base level of 100 points, so of course the starting point had to be lower than 100. Neither could the index start at zero, because anything times a zero is zero. That index would just flatline.

“Here Comes The Sun” is a song of such optimism, “We have been waiting such a long time” for better times to come, but the melody does become a touch repetitive after a while. Start to finish for a pop song in its era, took just over 3 minutes. If the song had grown by inflation since, it would now last for 1 hour and 3 minutes! That sort of repetition could cause madness, but the example does explain a little about the pernicious rate of long term rising inflation.

How did WWII get paid for? The short answer is it never did, but that enormous post war debt which seemed impossible to fathom at the time, now stands at just 2% of its former self in relative money terms. You see, as long as the interest is covered on the debt, the initial debt will eventually just take care of itself over long periods of time.

A healthy level of inflation is a requirement of any debt-laden country, to slowly erode the balance of the debt over the years. Obviously too much inflation and your currency becomes toast. Too little or even zero inflation is also bad for economies as there is no urgency to buy anything today when you know the cost will be the same for a few years. Inflation is like Goldilocks.

Measures of Inflation

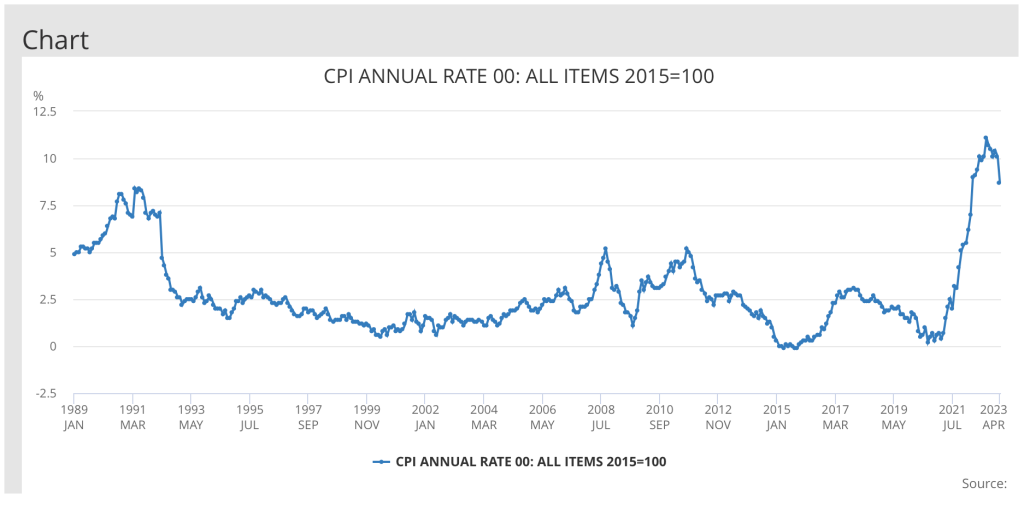

CPI (the Consumer Price Index) is todays mandated measure of inflation, but I didn’t use it in the example above as it didn’t exist in 1969. CPI is a relatively new construct, based at 100 points as recently as 2015. CPI brought harmonisation across Europe. The CPi is in fact the HICP (the Harmonised Index of Consumer Prices), which is a measure of Pan-European prices. Perhaps the CPI/HICP is no longer the best measure of our level of domestic inflation? Perhaps the CPI will be replaced eventually as the RPI was? Already the post Brexit index-du-jour is the favoured CPIH, (see what I did there just, for the French) which includes homeowners costs. Unlike in the UK, a large proportion of individuals live in rented accommodation across Europe so CPI doesn’t quite fit here as it excludes the costs of buying and owning your home. The level of CPIH is currently a little lower than CPI.

As inflation numbers grow it probably makes sense for Governments to cover their tracks and bring in another new measure of inflation, which will be based at just 100 points again of course.

| Measure | Start Date | Base | Currently | Increase |

| RPI – Long Run | 1947 | 30 | 1490 | 50 Fold |

| RPI | 1974 | 100 | 373 | 2.7X |

| CPI | 2015 | 100 | 130 | 0.3X |

US annual inflation is back down to 4.9% from its peak of June 2022 of 9.1%. Most of the hard yards have been run. The FED’s target is 2.0% but they will need to cease increasing interest rates well before inflation approaches that figure. There is a substantial lag between hiking rates and the effect of those rate hikes. The debt markets have priced in that rate rises could have already finished in the US and perhaps the first tentative reductions start around year end.

The Bank of Englands progress against target

Meanwhile over here in the UK, inflation finally peaked only in October 2022 at 11.1% and it now sits at 8.7% only 6 months on from the peak. In the US, 6 months down the line from its peak rate, inflation had fallen back 28.57%. Here 6 months down the line, the index lies 21.62% below the UK peak. We could suggest the Pan-European spike in the prices of gas and oil, caused by Putin’s war on Ukraine has caused a higher spike and a slower fall, but the UK does however trail both Germany and France in its fight against inflation so far. The UK has stickier inflation which will mean more interest rate rises ahead. I know I previously believed that there was perhaps no more than one, maybe two further smaller increases to come, but the debt market has shifted its views recently and they give a truer projection than either the Bank of England or the UK Government. I must therefore change my view.

A Disaster Averted

As an uplifting song, I much prefer “I Can See Clearly Now” by Johnny Nash, which was written back in 1971. Obviously not “all of the dark clouds that had me blind” have gone just yet, but one of those clouds, the US Debt Ceiling, has been moved away. The US debt ceiling agreement came only the day before national default was due. Once again US party politicians were putting their interests before the populace they are supposed to represent. The new ceiling agreement should act to bring down overall debt over the next decade by $1.5 trillion, a drop in the ocean compared with the overall debt of $31.4 trillion. Investors breathed a sigh of relief and the stock markets were stabilised once again. Huge numbers are hard to imagine. In comparison the UK has a debt of (just!) $2.2 trillion, whilst Apple has an asset worth approaching $3 trillion.

So tune in again on 1st January 2025 when the next US debt ceiling last-minute political negotiations have been settled once again. That will prove to be a nice Christmas for me. We won’t be expecting a Santa Claus rally at the end of 2024, so hopefully much of the heavy lifting towards market recovery will have occurred by then. Besides, despite this agreement, the US Government will probably have run out of money again well before Christmas 2024 for the 80th time since WWII.

Whilst “all of my obstacles have(n’t) disappeared” yet, as global inflation slowly resolves itself, allowing interest rates to reduce and the apparatus of US Government can continue, markets will recover. Despite the news of doom and gloom the markets are holding currently and after a long period of holding, the market charts do tend to resolve to the upside and a new rally commences.

Most potential outcomes not as bad as expected so far

The whole year has been characterised as lurching from one disaster to the next. The war in Ukraine, nuclear escalation, rising inflation, rising interest rates, the threat of interest rate rises causing a deep recession, the potential collapse of the banking system across the western world and the US running out of money. All very real threats at the time. Enough to cause anyone to decide to call it a day and run to cash. However none of those disasters actually played out with further disastrous market consequences. The UK is still not in the deep recession forecast by many. We probably will enter a shallow recession soon, but not before Germany has already hit the bumpers. At the half way point of the year our Moderate Portfolio has delivered the same return as an individual could achieve by tying up cash for a couple of years. With some of the best performance months yet to come.

I can foresee many investors currently holding cash at rates which look attractive today, wondering why they tied their spare cash up and subsequently missed out on the market bounce back. Our brains strike a fine balance, always flip-flopping between fear of losing out versus fear of missing out.

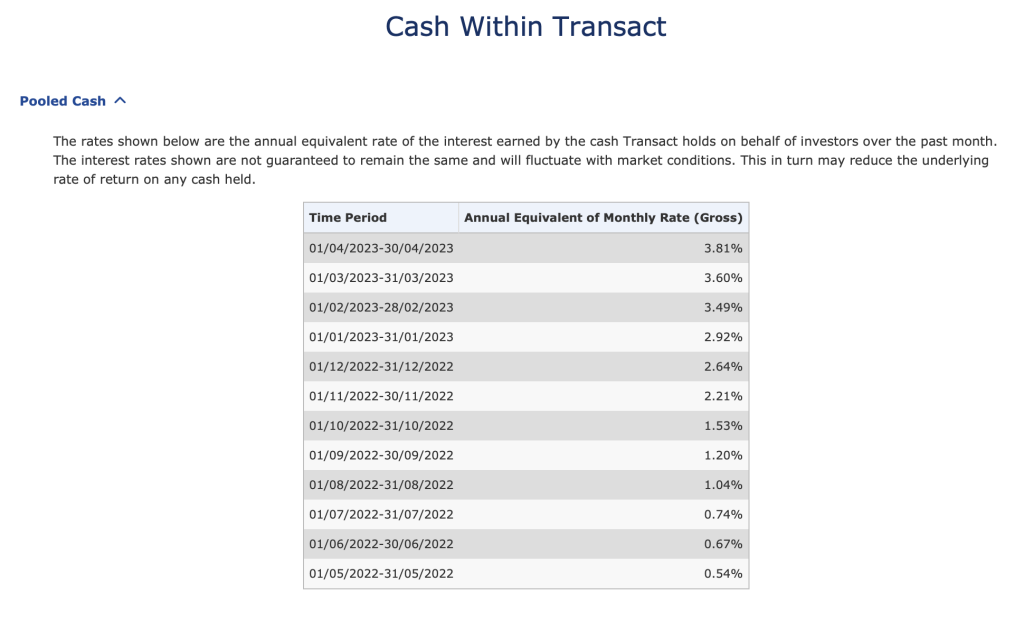

Don’t forget one of the benefits of transferring to Transact was the way they are fair with the cash we hold in our portfolios as clients. The current rate for cash held within our portfolios now earns 3.81% A.E.R.

Personally I feel that 18 months has gone by whilst I’ve just watched from the sidelines. Waiting for the first signs of rising investor sentiment to show themselves. I’ve hated it. Whilst I’ve been forever watching, willing and planning the action to be taken on the portfolios once the market direction turns upwards, I’ve been missing what is going on in life today.

The three time zones

I’ve talked before about the three time zones we flit between. The past, with experiences relived, both good and bad. The future, with news to come, again both good and bad. And finally the present. Bit by bit the present made up our past and will make up our future. We need to live in the present, because otherwise it just ebbs away.

We are not far from the longest day of the summer, as good as the weather has been, I don’t feel like it has been that enjoyable so far. I’m stuck waiting for the future instead of experiencing a full life today, packed with new memory making opportunities. We all need to live more in the moment. So if you have had a similar experience to mine since the last rally stopped, don’t wait until the next rally arrives to start living.

“That rainbow I have been praying for” certainly hasn’t arrived just yet and so I will remain vigilant, but I’m going to try to enjoy each individual day more in the meantime. I understand we have all experienced several market crashes and recessions in the past and I know we will face more in the future, but personally I would like this one to giddy-up towards its eventual full recovery. The recovery started last October I’m becoming increasingly impatient with its progress. Bring on “that rainbow I’ve been praying for” and try to enjoy the (usually) quieter stock market summer months.

And Finally, Remember

Waiting for market recoveries is like it used to feel waiting for a bus. You spent ages waiting, almost lose hope, then two come at once.

We totally agree and hope your efforts are rewarded. I feel a new car coming on!

I hope so. There is little to enjoy as a Utd fan for now but as Ted Lasso says “ Believe”

Thanks for your optimism Howard, it always makes us feel so much better.

We are soaking up the sun in a beautiful resort so the sun has already come our way this month.

All the best with your mission to start living life again.

Way to go! Enjoy yourself-it’s later than you think.

Don’t Stop Believin – Journey

We reap the rewards every day when you and we don’t stop believing.

Thanks guys. I appreciate it.