Why is the FTSE 100 doing so well?

Given the current global political uncertainty, coupled with an ever-escalating Islamic fundamentalist jihad causing atrocities around the world, why is the FTSE 100 sat virtually at an all-time high?

This is currently the most frequently asked question by my clients. I’m going to give you my best shot at an answer. Because it doesn’t stack up. Until recently, shocks like the kind we are seeing weekly would have the markets up and down like a yo-yo.

Actually the FTSE 100 just looks average in relative terms

First of all the FTSE 100 isn’t the stand-out best global stock market currently. In the UK the FTSE 250 has done better, as has the AIM 100 index. In Europe it’s a similar story with most markets now exceeding their previous 2015 highs. However towering head and shoulders above all other markets are those in the US. The NASDAQ and the S&P 500 continually push to another record-breaking all time high.

I believe the level of the FTSE 100 currently has little to do with our little UK economy. It’s certainly got nothing to do with May versus Corbyn or May versus Merkel. At times like this it’s good to remember our stock market is highly correlated with the US stock market.

The 3 current drivers of global investment

I believe it’s American’s driving our stock market. Consider these 3 certainties.

- The current instability of US politics

- US interest rates which are currently rising

- The vast wealth of the US middle-class

The US middle class have made an awful lot of money since 2009. House prices, wages and investment returns all up to record levels.

The way the US middle-class invest today is changing.

Less Shares

I’ve explained in previous blogs that to buy a share you need to find someone else to sell one. Share numbers therefore are finite. Except Increasingly many US companies have been buying back their own shares and thus take them out of circulation. The amount of investment opportunity is therefore reducing. This reduction is unusual. Normally the number of shares in circulation increase as more and more businesses list on stock markets. Reducing the number of shares in circulation increases demand.

Biased

Each country’s investors tend to exhibit home bias. We invest where we are most comfortable which tends to be in our own backyard. Americans invest exclusively in US shares more than most.

Diversification

Spreading your eggs across many baskets helps to smooth returns. Americans understand they now need to do this. But it’s hard to do as the returns that US large shares have generated have been absolutely prolific since 2009. As witnessed by the returns we have each received in our predominately US, global technology and health funds. US investors have started to spread their eggs recently as other countries stock markets begin to out-perform their domestic shares pretty much from the start occur this year.

Low Cost

As investors we control the only thing we can. Our costs. It’s almost a decade ago that I lost my faith in star funds run by star fund managers. Instead I decided to watch the pennies and be happy with the consistent returns that markets give. I switched to cheap index trackers. Today in the US, over 90 cents of every dollar invested ends up in index tracker funds. The former stars of Wall Street are in retreat. Their fancy wages being replaced by computers which cost hardly anything, don’t take any time off and don’t take increasingly higher risks to chase past losses. Hedge funds are closing down whilst the large fund groups like Blackrock and Vanguard expand.

With a passive buy and hold strategy, the well behaved should just ride the bad times out instead of trying to get out before it’s too late. And then get back in to the market before it’s too late again. A difficult task. Many realise that neither they nor the star fund managers that they used to worship actually own a crystal ball. I believe this reduction in trading has effectively “flattened out share prices”.

A vast number of US investors are changing their habits

So what would you invest in if you were an American? We can imagine the internal monologue.

Invest abroad? Well sure, but nothing too risky to begin with. Not China. Japan hasn’t grown for ages either. South America is just corrupt. Africa is just full of mud huts, I’ve seen it on National Geographic. Perhaps Europe. Wait a minute we are going to London England on holiday this year to see the Queen and Shakespeare. It’s become so cheap since that Brexit thing happened. The Greenback goes so much further there than in Euroland. But ain’t their law-makers falling out with each other? It don’t look like she is the new Iron Lady and he looks like he wears Walmart 99 cent slacks. But hey, they don’t got Trump either so that’s a good thing. Doesn’t the Queen Elizabeth run things anyway? I remember Warren Buffett tried to buy one of their little companies. (Unilever worth over £100 billion) If it’s good enough for him then it’s good enough for me. I’m going to buy a FTSE 100 tracker.

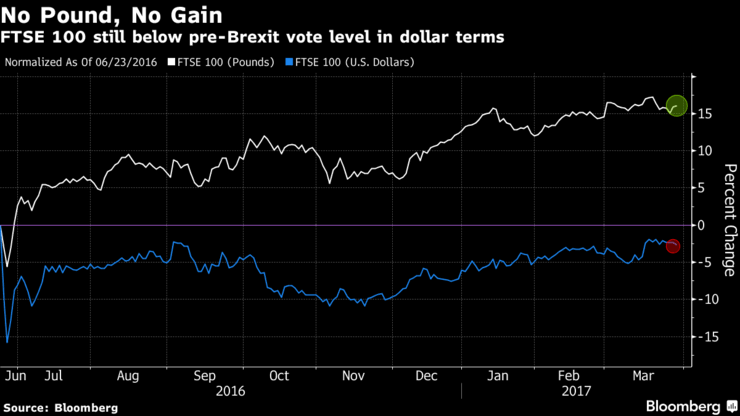

I apologise to all Americans now, especially those who are currently sharing my cruise ship in the Mediterranean, en-route to London. But let’s look at their view of our index versus our view to illustrate their (and every other Johnnie Foreigner’s) current opportunity.

In a nutshell

More and more investors are just buying a complete index these days.

Daily trading volatility is getting lower because investors hold an index for decades. Ownership of UK shares isn’t just the preserve of the readers of U.K. newspapers anymore.

When investing, always follow the flow of money.

Nice blog, Howard and insightful. A Private equity group investment in a company usually result in de-listing. Is this positive or negative?

Happy cruising.

Hi Dick

Once again thank you for taking the time to read and to comment.

It could be seen both ways. Positive as it reduces the investable market in total, which still retains the same number of investors looking for a good home for their capital. Technically providing less supply whilst demand remains constant.

But negative because good investment opportunities are kept off market. The venture capital groups take all the profit right through to the point where the businesses are returned to market with a much higher price. There have been many ‘Unicorns’ in the US. A company floating for the first time with a valuation in excess of £1 billion.

A typical politician’s answer I’m afraid. Yes but no 😀