When I first played Trivial Pursuit Baby Boomer Edition, I had no idea what a Baby Boomer was, or indeed that I may be one. After the end of WWII, the number of births rocketed in the US and only settled back to average figures in 1963. A similar increase in the birth rate happened over here too.

The vast majority of my clients are older than me, that makes them Baby Boomers too. What’s this got to do with investment?

Q: “Willie, why do you rob banks?”

A: “Cause that’s where the money is.” ~ Willie Sutton

Willie Sutton was born in 1901 and was a career bank robber.

Q: “Howard, why are nearly all of your clients older than you?”

A: “Cause more than 75% of the wealth in the UK is held by the 55 plus age group. You can see I would have an incredibly poor business model managing the wealth of the UK’s 20somethings.”

Howard Scott was born in 1961 and has been continually robbed by banks.

Much of this UK wealth is held in houses and cash, but the balance is held in pension funds, ISAs and directly in shares. Since I manage peoples life-savings, it’s not surprising that many of my clients are in this age range. This is what Baby Boomers have to do with investment. They are the primary investors.

In America in 1963 Lee Iacocca was involved in bringing the Ford Mustang to the market. The car revived Ford’s fortunes and along with subsequent sports cars, helped the company to enjoy an extended period of huge profitability. In 1983 when Chrysler was on it’s knees it poached Lee Iacocca and asked him to bring a new sports car to market which would save their company. He took the challenge and he eventually brought to market the Chrysler Voyager. You know, the seven seat van with sliding doors and a tailgate. Hardly a sports car! But it led the US automobile industry in sales for over 25 years. The reason he did this is because he knew that the same individuals who bought his sports cars of the 60’s had now grown up with families and needed more room. They may have wanted another sports car, but they needed cars suitable for families. He understood demographics.

Did you know an adult python can swallow a whole pig? Not nice I know, but you can see the bulge in the python slowly moving along as it is digested. A word of warning – never Google this, there are some awful images.

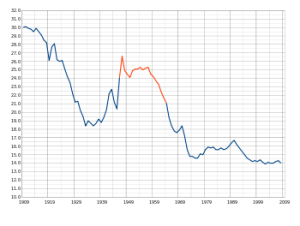

The Pig in the Python phrase was coined to describe the bulge in the birthrate as it moves along over the years. In the 60s the earliest baby boomers were busy buying sports cars. In the 80s they were raising families and buying mini-vans. Collectively they bought houses and drove up prices for a few decades. Stupidly they got involved with speculative Technology shares driving them ever higher until they eventually crashed in 1999. Today the eldest are 67 whilst the youngest are coming up to 50.

We are “The Pig in the Python” and what we are doing now and next will continue to drive my investment decisions. We are getting older but smarter. Are we getting more cautious? I’m not seeing that at all. Are we like the previous generation? – Hell no. I will follow up on this theme in later blogs, because us pigs, we are busy people and can’t spend all day reading.