Today is the first day of the second tax quarter and so an investment update is due. These updates used to take weeks to do and were then sent via the post. You were lucky to receive them within 10 working days. Now with the speed of the internet updates are becoming more instant. Indeed many clients regularly log onto Nucleus and SIPPcentre to see for themselves where their life savings lie in real time. So the purpose of these reviews has become comment rather than the numbers contained in your individual emails.

So what has happened and what am I expecting?

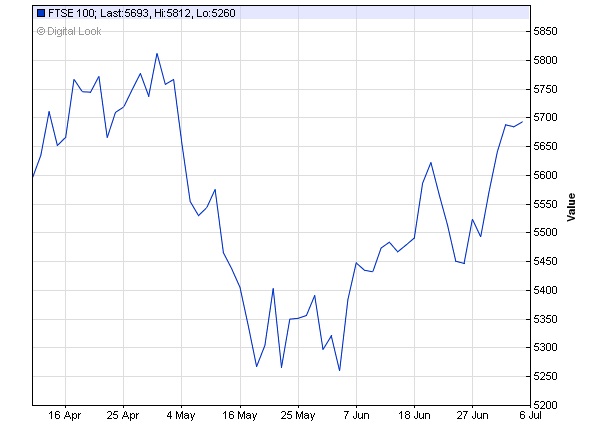

The FTSE 100 ended the quarter around the same level it started. The direction on a day to day basis was decided upon by investor sentiment as events across the English Channel unfolded. Debt problems at country level across the world and from Europe in particular dominated the news-flow. It was expected that there would be no growth from the levels achieved earlier in the year when the markets got ahead of themselves and climbed briefly above 5800 points. From there a pause for breath was expected over the Summer months. The end of quarter upswing reflects the fact that many institutional deals are placed and need to be settled by quarter end. This tends to lift markets at the end of each quarter. I have called it “froth” in the past.

I still believe there will be a limited number of days to come where earlier market lows around 5300 will be tested, before we get into the second half of the fiscal year where we typically make all our money.

What risks are there?

We have deliberately kept a lot of cash un-invested for the majority of our clients. Although we feel there should be no nasty surprises we did not expect to make much money over the Summer months, so why take the risks when the outlook for the return gained is low? Europe is far from fixed and so there could be more short term falls to come. China has needed some stimulus and the recovery in the US is slowing. However that said these are all “known unknowns” and nothing has really changed for 2 years now. The latest interest rate forecast from RBS is suggesting interest rates will now not rise until the end of 2015, which should translate to lower returns from shares also for a year or so to come.

Where are the opportunities?

Investment memories are short. If the bad news stops, expect the markets to rise. If their is more Quantitive Easing in the US, expect the markets to rise. I believe, like last year and the year before, growth will come but it will be concentrated in the last half of the financial year. Seven years out of ten this is true. Summer is a time for patience usually rather than expectation. That said the movement of markets is very random in the short term, we will continue to look out for opportunities and threats for you.