Was that finally it?

Over here in the US the market has just seen its best 2 day performance since May 2020. We saw what happened to the value of our savings after that 2020 turnaround – we rode up one of the strongest investment periods of all time. In case you may have forgotten, there was no good news to be had in May 2020 either, we were deep into lockdowns with many businesses struggling to operate. Then like now, there was just the expectation that conditions and sentiment couldn’t get any worse and so were likely to improve.

Today the US markets opened lower, bringing down the value of UK shares, but as I write this, they have clawed back up into positive territory. Unfortunately the UK markets closed 4 hours ago. Hopefully when the US market closes in a couple of hours time it will remain up for the day. That should precipitate a welcome higher open in markets across Asia and Europe as they catch up. How do I know? Share markets are correlated as many companies operate globally not just domestically.

And the cause of the turnaround?

Yes, it was the event everyone was waiting for, the Dollar stopped getting stronger. A Dollar weakening against other currencies, for those who have followed my blogs all year, is just what we and most investors were waiting for. Now hopefully this isn’t another false dawn like we experienced in April and July, when we experienced positive months, only to see the Dollar continue to strengthen bringing with it more negative months.

This time it seems different.

It was the way the Dollar stopped rising that made the difference this time. It literally shot up towards the end of last month. A trend is the direction of travel in a chart. Sloping up to the right of a chart is an upward trend. When the gradient increases to almost vertical, it usually signals the end of the trend, at least for the short term. Where a trend ends can also be “calculated” by technical analysts. It isn’t a precise science, more of an art with a bit of give in the outcomes. Funnily enough Dollar strength failed almost exactly where analysts were expecting. The final acceleration took the strength of the Dollar to the limit, which was tested and the direction of slope changed to downward. A pause was all the markets needed to sense the end of this 20 month period of weakness in the value of shares.

Contra-indicators

I’ve written so many blogs over a period now of just about 12 years and counting. I know I have discussed contra-indictors in the past, but I want to get this blog out quickly, so I am not going to reference where I have written about them before. However contra-indicators are almost always a good sign. Especially in the front pages of US financial press. When the headline is absolute doom, market recoveries start. When the headline is positive, it is time to look for the way out.

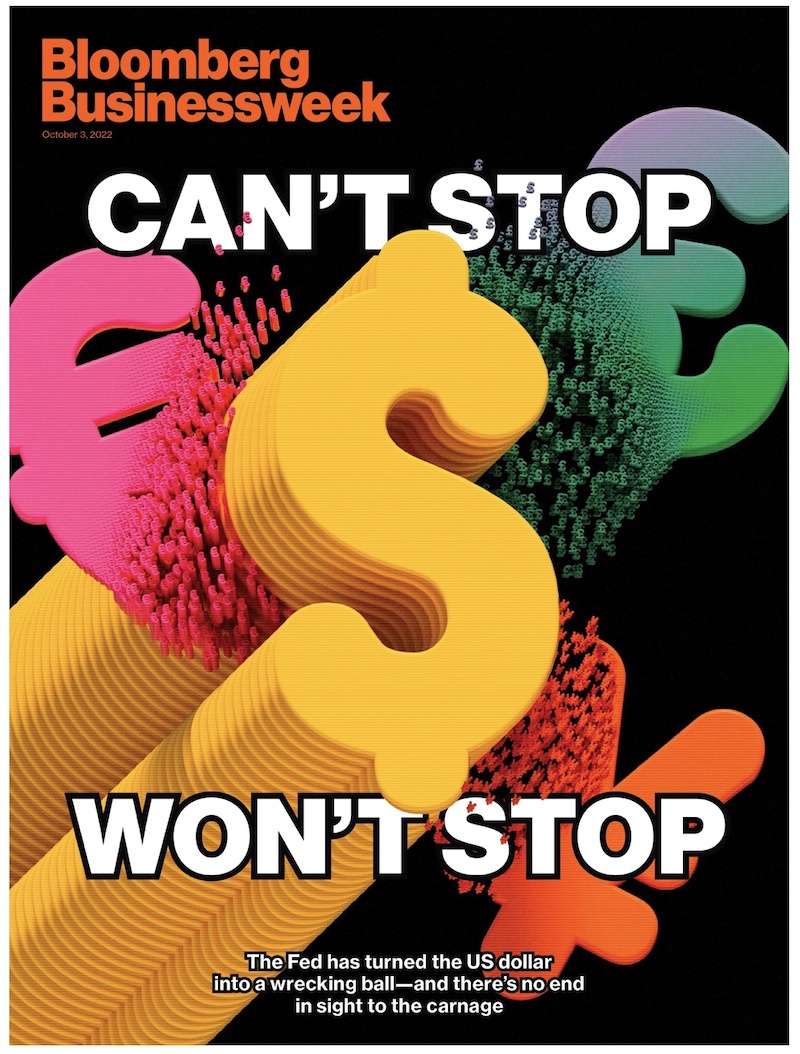

“CAN’T STOP WON’T STOP

The FED has turned the US dollar into a wrecking ball – and there is no end in sight to the carnage”

Bloomberg Businessweek – Oct 2nd 2022.

Let’s hope that once again the US financial press have called the bottom perfectly. Only hindsight will tell, but the Dollar cannot strengthen forever. We can see how markets react when the dollar pauses. Let’s hope it pauses for an extended period this time.

And now some excellent news!

Just before we left the UK, Charlie sat and passed her Discretionary Investment Manager qualification. It’s a huge milestone and I’m sure you will join me in congratulating her.

A massive achievement Charlie, well done and congratulations. Peter and Jill

Well done Charlie, cheers to you.

Thanks Howard, we keep fingers crossed and watch what happens.

Kind regards,

Congratulations Charlie. A great achievement.

Well done and congratulations Charlie.

Phil & Lorraine

Congratulation Charlie a massive achievement. Timely hopeful and reassuring update. Thanks

Fran and Lesley

Thanks to Howard for keeping the blogs coming & topical & a really big well done to Charlie.

Well done and congratulations Charlie.

Thank you Howard for the reassurance.

Peter and Joan

Congratulations Charlie what a great achievement.

Thanks Howard for all your blogs

Diane & John

Congratulations Charlie

I’m glad you look after investments Howard. If it was up to me, I’d be digging a big hole in the ground and burying cash!

Well Done Charlotte xx

Thanks Howard for the update again! A big well done to Charlie too!👏👏👏

Thank you Howard for the blogs, it’s good to have a better understanding of all that’s going on and congratulations to Charlie on her achievements.