Before I start this lengthy 2000 word blog, I would like you to know that you are free to leave before you get to the end. I won’t be offended. Please, only read what you need.

- You may fully intend to have a good bash at spending your life savings within your lifetime. In which case we are done, you can bunk off right now before I even get started.

- For everybody else remaining who feels they could encounter a problem in the future, stick around, but just as soon as you are satisfied it is unlikely you have any Inheritance Tax (IHT) to worry about, off you go. Your time on the planet is precious.

Let’s begin with my little rant, so you can see my starting position

So correct me if I’m wrong.

- I work hard throughout my life whilst I acceptingly pay my share of income tax and national insurance.

- I’m then free to choose how much to spend and how much to save of what’s left of my income after these tax deductions.

- If I save some money, I have to choose financial products wisely, like pensions and ISAs, to avoid further income tax and capital gains tax on any savings growth achieved.

- The money I choose to spend is subject to further tax, added as VAT on most of my purchases. Not to mention a plethora of further tax, added as duties;

- if I travel by plane.

- If I drink alcohol and my car drinks petrol (I do & it does)

- If I smoke fags or place a bet. (I don’t, but many do)

Then finally I die and the taxman wants to take a further tax bite! Oi Taxman, You’re havin’ a laugh!

Dave v Jezza

So let my try to explain how the final tax slap works. It’s called Inheritance Tax (IHT). Straight from the get-go, I want you to know, that you will never know. You could memorise every single fact and detail of the Inheritance Tax Act 1984 today and it would do you no good. Because none of us own a crystal ball. It’s a fact that political ideologies have vastly differing positions here. You could imagine the common ground David Cameron and Jeremy Corbin hold in this area. One has benefitted from complex offshore trusts, the other can’t even complete his own tax return correctly. Legislation has and will continue to change. Inheritance Tax is possibly the largest political football, every Parliament takes a kick of the ball for political gain. The tax regime in place will differ depending on the political party in control at the time of your death.

It makes planning both very difficult and never-ending. It’s a bit like riding a pedalo back to shore. You can plan your direction, you can both pedal with all your might, you can adjust the ridiculously vague rudder, but whether you arrive at your chosen destination probably has more to do with the wind and the tide. Both external forces like politics.

Still – I mustn’t grumble. Knowing this ever-changing, boring tax stuff that saves clients hundreds of thousands of pounds, should keep me gainfully employed well into the future. After all, I can only continue to act like Robin Hood whilst there is an evil Sheriff of Nottingham. Now where have I put my green tights?

“Look away now if you don’t want to see the result”

Before the worldwide inter-web thingy came along, we probably all remember trying to avoid the match result, so we could enjoy Match of the Day as if play was live. I’m going to do the opposite here. I’m going to begin with your result. It won’t spoil the outcome for you, it will probably just allow you to leave the blog earlier, stop worrying and continue to get busy living. Please don’t look away now.

And the result is…..

Before I tell you the answer I would like to explain why you have found most forms of tax complicated in the past. They are supposed to be! That way you won’t take any action, get caught out and simply pay more tax.

Inheritance Tax is charged at 40%. Most families should never have to pay it if they take advice and plan.

Let’s try to strip this down and dispose of the need to remember lots of useless ever-changing small allowances.

I read an excellent book by Stephen R. Covey early on in my career, it taught me a lot. One of my favourite chapters was “Begin with the end in mind”.

We tend to encounter a problem and then look for a solution. We solve one problem then move on to the next problem, and the next and so on. Each solution sits on top of the previous solution like the rungs of a ladder. We climb this ladder of solutions to reach the top. Job done. But before we started to create our ladder, we should have checked we had it positioned against the right wall. Duh! Solved everything but didn’t get to where we wanted to go.

Begin with the end in mind. So if the destination is mitigating Inheritance Tax (IHT), where do we need to start?

Understand when IHT becomes payable

You are not taxed of course. After all you must be dead to trigger the Taxman’s interest at that point. So IHT won’t cost you a penny. There is no limit to how much you can leave your spouse if you are still legally married when you shuffle off this mortal coil. IHT only kicks in and needs to be settled with the Taxman upon the death of a survivor of a marriage. The IHT has to be settled before any beneficiary can receive their legacy in most cases.

Here’s the standard wealthy family position

Please forget;

- Trying to learn when you can gift £3000 to a child.

- Calculating the correct level of gifts on a marriage.

- Recording any £250 cheques given as gifts to all and sundry.

- Creating tax efficient wills and trusts.

- Toting up 7 years of regular expenditure.

For the majority of individuals, All of the above are simply climbing a ladder to nowhere useful.

Instead;

- Work out your expected total wealth on death including the value of your home.

- Include any life assurance plans that are not already in trust.

- Subtract any pension funds you have not taken yet or that are currently in drawdown.

- Remember annuities don’t count, neither does the state pension.

- You may need to add back any hugely generous gifts you have given to the kids recently.

- Finally subtract the £650,000 joint allowance. Never married? Then subtract £325,000.

Nothing left? Good. It means no IHT is due.?

Aren’t you glad you didn’t bother with the fine detail first. You guys are now dismissed knowing that currently Inheritance Tax will not be a problem for your kids. Get back to enjoying your life.

The new personal IHT Residence band

If your joint estate currently exceeds £650,000 between you, don’t dispair,

The IHT free allowance just gets better between 2017 and 2020

2016/17 |

2017/18 |

2018/19 |

2019/20 |

2020/21 |

|

|---|---|---|---|---|---|

| IHT nil rate band | £325,000 | £325,000 | £325,000 | £325,000 | £325,000 |

| Residence nil rate band | £100,000 | £125,000 | £150,000 | £175,000 | |

| Total nil rate band | £325,000 | £425,000 | £450,000 | £475,000 | £500,000 |

Here’s the same wealthy family position by the year 2020

Everything I just said above, but with some additional go-faster stripes. By 2020 you still won’t break the upper limit leaving as much as a cool £1,000,000 between you. The tax calculation becomes more complicated however, because the £1,000,000 needs to be held across the correct combination of asset types. The additional £350,000 joint allowance can only be used against your home. No home, no additional allowance. Home worth £250,000? Then only a £250,000 additional allowance. You can even sell your home before you die, but terms and conditions apply, see in store for details. i.e. Ask me.

Likely to die and leave less than £1,000,000 after 2020? Good job! You are also dismissed. ?

However the next UK general election will be held on 7th May 2020. A change of Government could signal an impending change in IHT Legislation.

Right, who’s still reading?

Those still reading are firmly in the Taxman’s sights

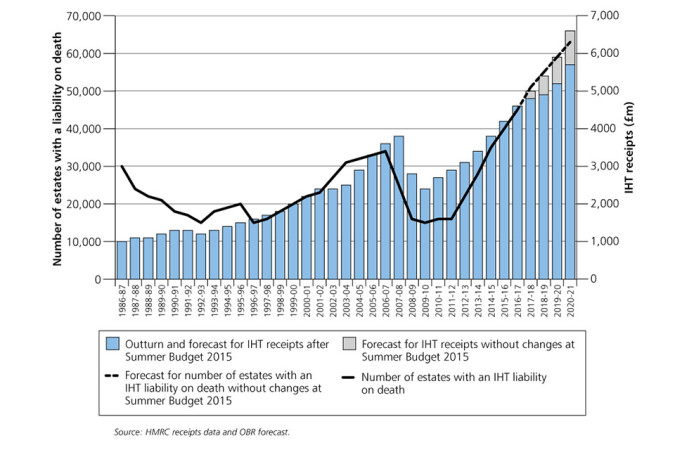

IHT charged to UK estates continues to climb. The Taxman’s IHT receipts are closely linked to the value of UK properties. This is because there are several strategies available to reduce the IHT burden, but it’s all but impossible to remove your home from your estate.

“Houston, we have a problem”.

IHT is hardly a life threatening problem like the one overcome by the crew of Apollo 13. But it certainly is lifestyle threatening. In fact it’s a problem, but it’s a nice problem to have. Each year only roughly 40,000 families are taxed. To be in this rare position in the first place probably took years of hard graft and many financial risks. Well done. But we don’t have to take the final tax slap lying down. We can plan and fight. It’s not illegal.

“No man in the country is under the smallest obligation, moral or other, so to arrange his legal relations to his business or property as to enable the Inland Revenue to put the largest possible shovel in his stores. The Inland Revenue is not slow, and quite rightly, to take every advantage which is open to it under the Taxing Statutes for the purposes of depleting the taxpayer’s pocket. And the taxpayer is in like manner entitled to be astute to prevent, so far as he honestly can, the depletion of his means by the Inland Revenue”

Lord Clyde: Ayrshire Pullman Motor Services v Inland Revenue (1929)

Let’s remember that IHT legislation has been written by those who themselves must be subject to IHT. They have created legitimate back doors. Escape routes that can be used safely. IHT planning needn’t be done through offshore companies and fancy Panama lawyers. I do it for clients and they have no fear their names will feature in shame in ” The Truth”.

“Inheritance Tax is, broadly speaking, a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue”

Roy Jenkins MP, Commons debate (1986)

The basic anti-IHT efficient estate structure

The new additional allowance will reduce IHT payable by up to £140,000 on your home, but to achieve these savings requires some planning. Your final family home should be valued between £350,000 and £1,000,000. The rest of your estate needs to be held in assets than can be placed in trust (effectively given away to your beneficiaries now) or held in investments that are exempt from IHT. This helps you to retain some control. The other commodity we all need is sufficient time to plan.

“I was just a boy – giving it all away”.

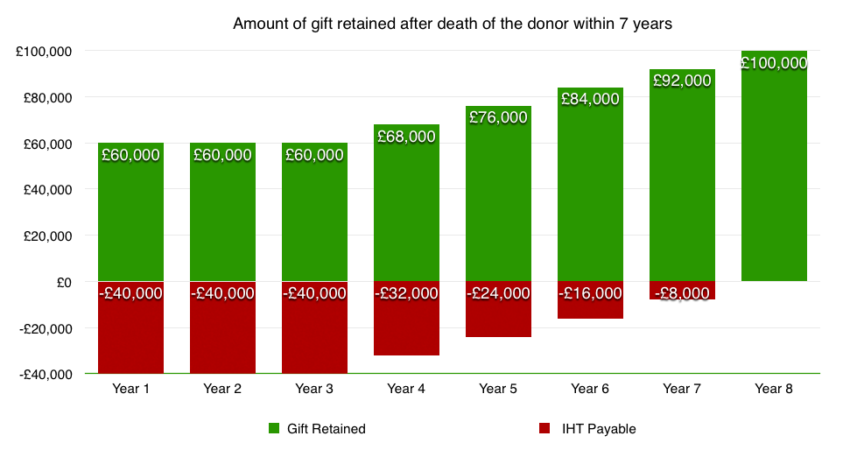

If you make gifts to children, tax is still due if you die within 7 years of your gift. You do have some annual allowances you can use, which do not carry the 7 year survivorship term. But on the whole these are relatively tiny and will not change the tax bill much. If you want to know how much you can gift each year click here.

“I want it all, and I want it now”.

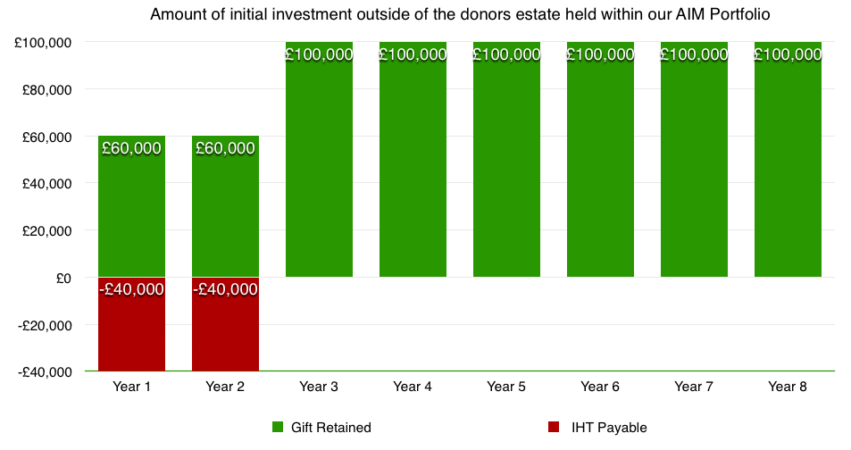

However you don’t need to give away all of your wealth. A little known planning opportunity arises through an IHT exemption called “Business Property Relief”. The clue isn’t found in the name to help us discover this legitimate IHT exit route. It has nothing to do with property, either a home or a commercial property. It’s all to do with holding selected smaller shares. If you invest in exempt smaller shares, a survival period of only 2 years is required and these shares can be grouped within investment wrappers, even within existing ISAs. It’s not for everybody, but ask me and I will advise whether this is suitable for you or not.

The services offered by H.J.Scott & Co.

We recommend trusts, we draft client wills and we recommend investments within the Alternative Investment Market which qualify for Business Property Relief, making them exempt from IHT. (blog to follow). This year let’s revisit your current plans or commence your own families pedalo journey away from the grasp of the Taxman.

There’s a lot of information here. This information does not constitute financial advice. We do not offer financial advice through our blogs. Our personal recommendations are only ever presented face to face to our clients.