It’s many years since I completed a jigsaw, but recently I came across a partly completed puzzle of a Spitfire flying into the sunset. It struck me that we vary hugely as individuals and yet we approach many problems in exactly the same way.

Most people, maybe all people, start with the corner pieces of a jigsaw. Then all the edges are completed to create the overall size of the puzzle. Then the detail and finally the undifferentiated areas like the sky. Pretty standard stuff.

We don’t just approach jigsaws in this way, but pretty much any problems or questions we have generally.

What the experts say

This is what behavioral economists call framing. Framing refers to the fact that we tend to draw different conclusions from information depending on how it’s presented to us.

Marketers know this. That’s why “buying opportunities” are presented to us in frames of their choosing. They don’t want us to create our own. Want to sell someone a car who has no savings?

“With no deposit down and just £199.99pm

Leave out of the frame the full price, the interest rate charge and the long term nature of the payments. That can be handled in either the small print, or in that ridiculous super-fast narrative at the end of the radio ad.

I once bought a 4 year old 5.5 litre Mercedes convertible. It was a very low, sleek car and I have to say, a perfect car in every respect. I should have kept it forever. I had seen the car because the sales team at Bolton Mercedes had positioned it in the corner of the forecourt up on a ramp. A perfect example of framing. I had only popped out to B&Q for 5 litres of white emulsion.

Was I looking for a gas-guzzler that could only manage 20 to the gallon? Would I ever get the opportunity to drive down Chorley New Road topless? After all Bolton has to be up there as the rainiest place in the world after the rain forrest of the Amazon.

My conclusion was that mileage didn’t matter when you only cover 5000 miles a year and besides, Lesley’s car had a roof for when it rained.

We always need to pause and re-frame the information. It’s important that we set the frame to match our objectives.

Look before you leap

Which brings me to today’s message. European financial legislation called MiFID II has recently brought in the requirement for a couple of client reports. The first is the requirement to notify a client if their portfolio falls by more than 10% in a quarter. This report needs to be with the client within 24 hours. We have to assess this every single day for every client. In the last quarter we sent some out to our more adventurous investors. Is there a MiFID II 10% gain in a quarter report as well ? Er, No.

Secondly, and again linked to the same quarters of January, April, July & October is the quarterly valuation report. Completely useless as all of our clients can get a live valuation 24/7 if they login. Nevertheless, it’s the law.

Clients generally want me to look after their life savings forever. Twenty, Thirty, hopefully more than 40 years. I have never had a potential client say:

Here’s my life savings, you can have them for a quarter and we will see how it goes after that.

You’ve Been Framed!

I think the quarterly framing that the recent European legislation has brought in to focus is detrimental to everyone’s mental health. Humans hate losing more than they love winning. A quarters performance should never be focussed upon. Even a year is a short term when we are investing over lifetimes. We need to be encouraged to make long term investment decisions. That can’t happen if we focus on quarters. I never select a share hoping it will be significantly higher in 90 days. If it isn’t I’m not going to sell it. Thankfully my clients understand the long-term nature of the decisions I make on their behalf.

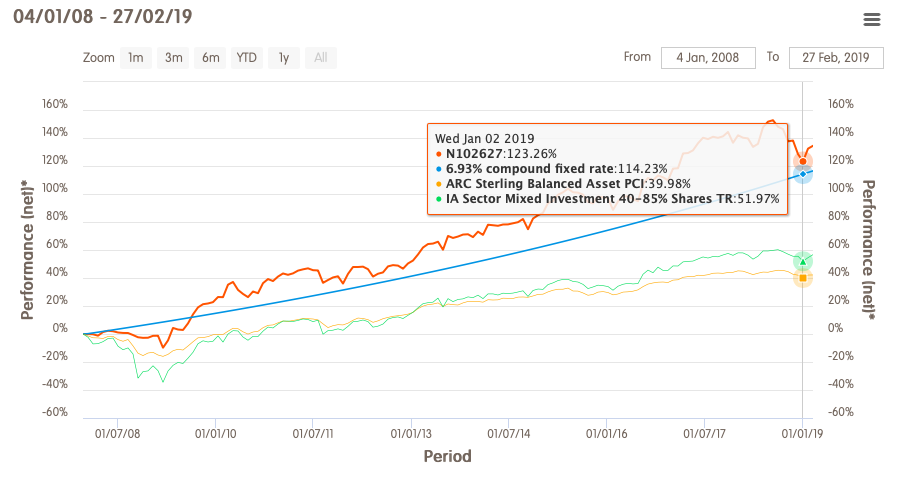

And by the way, the level the Moderate Portfolio dropped to on 1st January 2019, was down to only 123.26% up since January 2008. That return even after this recent setback, comfortably beats my goal of doubling the money invested in my Moderate Portfolio over a decade . As I write, the subsequent bounce has taken the Moderate Portfolio back up to 134. 44% since January 2008.

So its looking like the next quarterly valuation is on target to look like a bumper one. Whatever happens, what’s my advice? Please don’t focus on the period or the result. Remember your framing of your lifetime investment goals. Quarters don’t matter. Ignore them. By the time you receive the report, it is already out of date.

Now I’ve swung back down again its worse than it was before. If I hadn’t seen such riches, I could live with being poor

James – Sit Down

Always remember that if this volatile period has made you too uncomfortable to bear easily, we do have other investment portfolios. Please come in and sit down, sit down, sit down, sit down – sit down next to me.

[embedyt]https://www.youtube.com/watch?v=Ew7Zkkucos8[/embedyt]

Hi. I used to do commercial myself and worked out that every one looks at things through a window and my job was to align the windows so that both parties saw the same end product! Well done Howard our windows are aligned