Who can we trust?

One of the reasons we chose Nucleus as our preferred platform back in 2007, was because of their simple and transparent charges. There was nothing hidden. We knew exactly what their service would ultimately cost our clients. We knew that was value for money.

The same simplicity and transparency wasn’t the case throughout the rest of the investment industry though. Often what appeared to be incredibly cheap charges amongst the larger platforms, didn’t tell the whole truth.

Rule #3 “If it looks to good to be true then it usually is”.

Many platforms charged but then also accepted third party payments through the back door. Of course all charges are ultimately paid by our clients.

We weren’t going to allow undisclosed back door charges to suppress our investment returns. Our business proposition has always been win/win. The more you prosper as a client, then the more we prosper as your advisers. Simples.

Where’s this going?

This brings me neatly to a letter all SIPPcentre clients are currently receiving. SIPPcentre was our first platform and remains our second platform by amount of assets held. My own pension is still with SIPPcentre. The letter announces their change of name to AJBell Investcentre and below this is the important news which they didn’t want to take the headlines. News which they hope slips in under the radar. They are finally “fessing up”.

“Important changes to your fund holdings in the Funds & Shares Service”

This paragraph describes the conversion process of changing to clean share classes from the previous bundled share classes.

Now is it just me, but calling something a clean share now just makes it seem previously a grubby or downright dirty share?

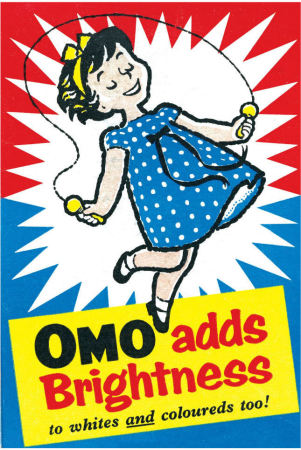

Why the need to suddenly announce the change to clean shares? Well its industry wide and driven by the FCA. In fact some platforms like Standard Life and Hargreaves Lansdown are even calling their new share classes super clean. Whatever next, “Biologically ultra clean with a bluey whiteness”?

Previously there were bundled share classes. They were the soiled bad boys living in the shadows. Undisclosed bundled charges typically have cost us between 0.25 – 0.35% of our life savings every single year. The platform was the beneficiary of this money. Over a lifetime this becomes a significant amount.

Maybe Hargreaves Lansdown wouldn’t be a FTSE 100 company today if its customers had known about these dirty back-handers all along. Their clients thought they were paying very little.

You’ve been found out

Anyway, rest assured. We rumbled this sneaky bundled class caper 8 years ago. We have not played the game since and so our clients are unaffected by the current changes. We don’t invest in dirty funds where a back-hander is paid to the platform. A typical fund we invest in doesn’t cost the typical industry standard 1% p.a., it costs just 0.2% p.a. There is simply no room to overcharge a customer and refund part of the already skinny fee back to the platform.

The exception to the rule

There is one exception however; we invest in the Henderson Property Fund. It’s actually the dearest fund we own but we feel its worth it. You can’t track a commercial property index, you need to own physical properties. Every property fund is different as it holds different individual properties. If we want property in our portfolios , which we do, we need to invest in an active fund. Held on Nucleus, it has always been “clean” share classes, on SIPPcentre that has not been the case until recently when they were forced to change, along with the rest of the industry.

As soon as SIPPcentre offered the clean share class we moved our clients to the new clean share class, reducing the charge from 1.0% to 0.75%. It’s what we do. We have your back. The more you prosper the more we prosper.