How am I doing?

This quarter the FTSE100 has sunk to a level not seen since February. The index finishing 338 points or just less than 5% lower. It began the period at 6,866 points and suddenly fell to end the quarter at 6,528 points. As you will remember from reading my July 2014 investment review, I was far from confident of the FTSE100 remaining at that high level and therefore was holding a high quantity of cash, awaiting a suitable time to re-invest when the market turned lower.

The FTSE100 index over the last 12 months

However the FTSE100 is only a proxy for what investment markets are doing globally. We quote it because the media quotes it each day. We do not invest directly in that index.

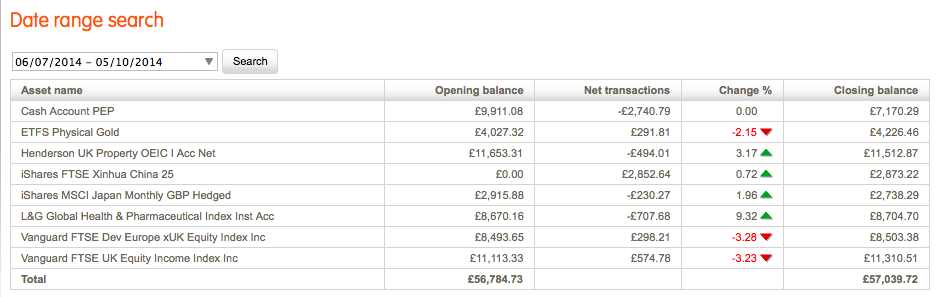

You can see how a typical Moderate client has faired over the quarter below.

Our chosen UK investment fell by around 3.25% as did our European fund. Elsewhere we have enjoyed a rise in our other equity holdings. Our Japanese fund grew by 2% and our Global Health fund grew by an astonishing 9.25% over the quarter.

All commodities which are denominated in Dollars have fallen, so once again our small Gold holdings have not helped our growth. Our property fund however has provided solid returns once again over the period.

You can see we took some profit from the better performing funds and added to the poorer performers. We also added a Chinese fund after the unrest in Hong Kong lowered the market enough to make it a buy.

We still hold a lot in cash and no Government bonds.

Why has the Global Health & Pharmaceutical Fund done so well?

It’s a combination of things.

- Firstly, if you are planning a trip to the US you will have seen that our currency has weakened against the dollar and this fund is denominated in dollars.

- Secondly, I’m certain the Ebola virus has caused speculators to buy any pharmaceutical shares which could benefit from increased production and sales.

We still regard this fund as a long term hold so we have cashed in slightly on it’s strength to take some profit.

So what next for markets?

Take a look at the VIX – commonly known as the fear indicator – on the rise which means a higher period of volatility ahead. This has already begun to show itself with record day climbs and record day falls now beginning to occur.

I have made some initial changes to our portfolios already and am on constant standby, expecting to make more changes in the next few weeks I guess. September and October are typically the time of year that all the shakeouts occur. Then the markets start an upward trajectory again.

The FTSE100 at 7000 by Christmas? I have been expecting it for 3 years now but each time Santa has failed to deliver.

When is the next update?

These updates are quarterly so we will write again in early January 2015.