This blog looks a bit long, can you cut to the chase because I’m busy?

During 2013:

- Cautious Portfolios grew by 7.65%

- Moderate Portfolios grew by 11.90%

- Aggressive Portfolios grew by 13.96%*

During 2012 & 2013 (2 years total)

- Cautious Portfolios grew by 14.19%

- Moderate Portfolios grew by 19.54%

- Aggressive Portfolios grew by 24.31%*

Assuming they have been invested with us over the whole period; These are the actual returns our discretionary investors have received after our fees, platform charges, fund fees and dealing charges have been paid. They are not to be confused with performance figures given by fund managers who do not include all costs and do not account for custody, settlement and advice costs.

So I can expect that level of return in the future then?

Well no.

*Past performance isn’t necessarily a guide to the future

We humans extrapolate. We look at what has happened in the recent past and then use this as our model for the future. This has got us through 2 million years so far.

- Tigers kill us – best avoid

- Toadstools usually kill us – best avoid

- Everyone is doing well invested in shares – Let’s buy now. I don’t think so.

- Everyone has lost loads of money in shares – I’d better sell mine. Again, I don’t think so.

So short term extrapolation is the worst thing you can do in investment. Let’s not buy high, sell low and repeat until we are broke. If I was remunerated for selling individuals investments I would be shouting “get in now, just look at how we have done”, but I’m not, I’m paid to help investors look after their life savings in harsh times and prudently help them to grow their life savings in good times.

Does history teach us nothing then?

We should ignore what has happened in the short term, in fact we should often do the opposite! But long term investment truths do show through.

We are here! Shouldn’t I be worried?

The chart shows the S&P 500 and the FTSE 100 over the last 20 years. The S&P 500 has never been higher, the FTSE 100 is not far off the high it reached in 1999. Twenty years experience (I’ve only been involved with investment for 27 years) would suggest we are about to enter the highway to hell for several years. The markets must fall. All those latecomers who are only just investing are going to get burnt surely? It probably won’t be the first time they were late to the party having only just got over their losses in 2008!

You may have noticed that your plans are very cash heavy at the moment, and I think now you can see why.

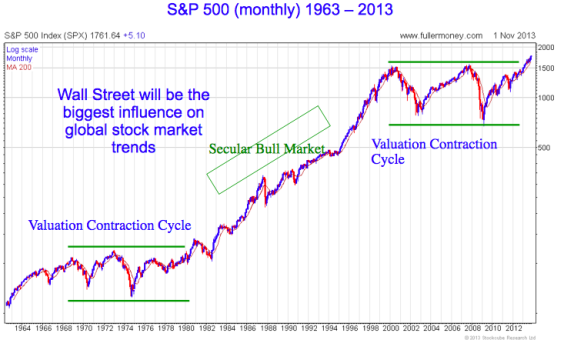

Now this would be the end of the blog if I hadn’t been to lot’s of meetings in November and December. I decided I needed more experience than just 27 years to try to figure this out so I went along to listen to individuals that have been successfully investing since the late 60’s. I was only born in 1961. So look at the chart below.

The two charts end at the same point. That doesn’t look too bad does it? Perhaps this isn’t a re-run of the last 20 years. Maybe it’s a re-run of what happened after the recession of the 1970’s? Maybe we are about to embark on an extended period of huge global growth. This time brought about by ever accelerating technology, a huge migration to the middle class in Asia and cheaper global energy costs. (not in Europe but in the USA where energy costs are 4 times cheaper than Germany where they won’t frack) Any one of those factors alone could fuel a boom.

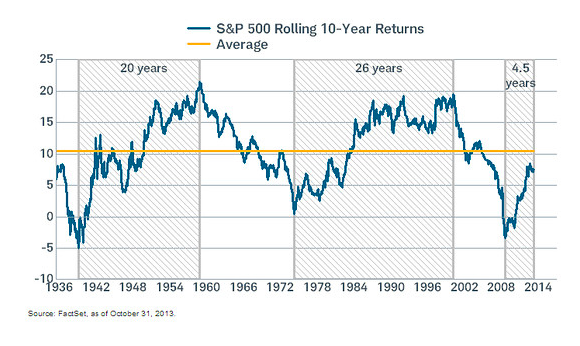

The same graph below is another I came across at an investment meeting, where the same conclusion has been arrived at but it suggests the boom has started already and probably has a further 20 years or so to go.

By the way, I never attend meetings where products are being sold or there are vested interests at play. I pay to attend these meetings.

Now I’m confused. What are you going to do?

I’m going to carry on each day with an open mind and look for trends to develop. I am certainly not going to try to best guess whether we are on the edge of the abyss or about to embark on the investment journey of a lifetime. When I’m not sure I ensure profits are made safe so losses will not be huge, especially when we have done so well over the last couple of years.