How am I doing?

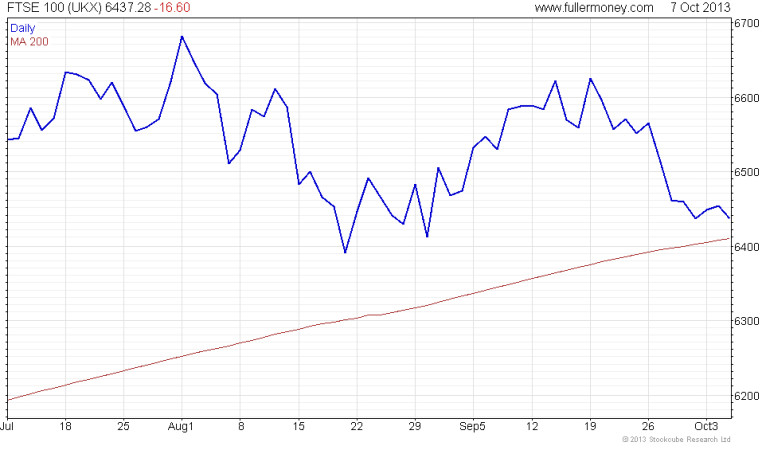

Like all world markets over the quarter, the graph above shows that the FTSE 100 ended the quarter lower than it started. It began the period at 6,513.08 and drifted down to 6,453.88. It now stands at 6339 whilst we wait for the American politicians to sort themselves out. We predominantly invest in index trackers, which always track the index both up and down and so many clients would be expecting their portfolios to be down. However we are pleased to say that our strategy over the last 3 months has meant that each portfolio has grown. Exactly what we have done on your behalf will be confirmed in the next blog to keep this review suitably short.

What have you been doing? There have been lots of contract notes flying around again

Once again like the previous three years, the Summer months did very little for client fortunes. In July we said that this year feels different. We felt it was time to buy and hold as the economic recovery continued, but by early August the market had got ahead of itself again and so we sold 50% of our clients’ equity holdings. That left each client account cash rich and able to take advantage of the next period of market weakness, which looks like it could be anytime now!

Why the big fall in the markets from their August highs?

As you have guessed it’s the largest investment market in the world that drives everything. Markets had got a little ahead of themselves again and with the political uncertainty, the shutdown and the US debt re-negotiation many investors, us included, had decided to take some profit. Like all previous US political showdowns however, it will be resolved but will probably go to the wire. As Winston Churchill famously said in a considerably more dramatic context:

“You can always count on Americans to do the right thing – after they’ve tried everything else.”

So what next for markets?

We don’t have a crystal ball but we are entering the time when traditionally Western markets typically pick up. Many clients understand that we like to be fully committed at this time of year through to April time. However, could we really expect the markets to perform in the same way for 5 years on the row?

When is the next update?

These updates are quarterly so we will write again in early January.